Sorted by date Results 1 - 25 of 47

As noted by Benjamin Franklin, “in this world, nothing is certain except death and taxes.” For some taxpayers in just a few states, that quote can be changed to include taxes for dying as well. Washington is one of just 12 states that impose an estate tax (commonly referred to as a death tax) and is the only state without a personal income tax to have one. To make matters worse, our estate tax currently has an inoperable inflation index, meaning more and more taxpayers are falling prey to it. The reason for this is that the federal report our...

For months I’ve been asking the Department of Revenue (DOR) if it plans to collect the capital gains income tax that was ruled unconstitutional by an Inslee-appointed judge on March 1. The answer has consistently been: “That decision has not been made yet.” Yesterday, however, the Attorney General (AG) helped definitively answer that question by filing a motion with the state Supreme Court asking the justices to allow DOR to collect the capital gains income tax before a final ruling on the case. In fact, the AG argues that those chall...

Nine hundred and seventy five days later, the Governor’s emergency orders related to COVID-19 are finally ending after today. Now begins the next steps for legislative reforms and a court date before the state Supreme Court. The state Supreme Court announced last month that it has agreed to hear a case challenging the authority for the Governor’s emergency powers, as well as reviewing if some of his prior orders violated Washington’s constitutional protections for contracts. The case is Gonzales, et al. v. Jay Inslee & State of Wash. According...

The Citizen Action Defense Fund (CADF), a local government watchdog nonprofit in our state that files lawsuits, sent the Department of Revenue (DOR) a letter today demanding the agency stop its rule-making activities to implement the capital gains income tax. On March 1, an Inslee-appointed judge ruled that the capital gains income tax “is declared unconstitutional and invalid and, therefore, is void and inoperable as a matter of law.” From the CADF letter to DOR: “It is black letter law that statutes declared unconstitutional are deemed void ...

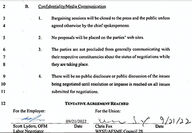

OLYMPIA–Unless the legislature decides to step in and require transparency for state government employee compensation talks, they will continue to be conducted in secret based on an agreement the Governor's office recently reached with union officials. Section 39.13 of the tentative 2023-25 contract for state government employees maintains secrecy for future compensation negotiations. Under the heading "Confidentiality/Media Communication" the new contract says (page 176 of pdf): 1. "Bargaining...

Governor Inslee announced today that he will finally end governing under an emergency order, after more than 900 days, on October 31. When the legislature next convenes it should ensure that this type of ongoing emergency governance without affirmative legislative approval never happens again. Whether or not you agree or disagree with every decision the Governor has made for the last 900-plus days, the fact remains these decisions with vast impact on individuals and businesses were made behind closed doors in the executive branch. It is true...

On February 29, 2020, Governor Inslee issued a declaration of an emergency related to the COVID pandemic. Since then, the Governor has issued numerous emergency orders either waiving various laws and/or imposing restrictions on citizens and businesses. While most Governors across the country have already rescinded their emergency declarations (or had them automatically expire), Washingtonians will have been living under emergency governance for 900 straight days on August 17 this week. Our Governor has provided no metrics or estimates for when...

The Washington Education Association (WEA) on June 30 filed a legal brief with the state supreme court in the capital gains income tax case asking the justices to change their prior rulings and now declare that income isn’t property (meaning you don’t own it). This is precisely the legal strategy that some supporters of the capital gains income tax planned realizing that voters keep rejecting constitutional amendments. The hope of income tax advocates is to use the new capital gains income tax to get the justices to change the rules of the gam...

Proponents of the unconstitutional capital gains income tax are working overtime to prevent voters from weighing in. First, there was the game last year with the emergency clause to prevent a referendum. Now capital gains income tax supporters are gearing up to counter a potential I-1929 signature gathering campaign by setting up a surveillance system to report any ballot petition signing locations. As reported by the Everett Herald: “Should I-1929 petitions get circulated, opponents won’t be sitting idly by. They set up a hotline Thursday tha...

We can now add the Attorney General’s Office to the list of state officials apparently ignoring the Douglas County Superior Court ruling that unequivocally said the capital gains tax is an unconstitutional income tax, not an excise tax. Despite this court ruling, the Attorney General (AG) referred to the capital gains tax as an “excise tax” in the language submitted for the I-1929 ballot title and summary. The I-1929 campaign told me today it is currently reviewing the AG’s ballot title and summary language to determine if it will appeal....

When a court rules that a tax is “is declared unconstitutional and invalid and, therefore, is void and inoperable as a matter of law,” what happens next? One would think that means efforts by state officials to put the tax in place would be stopped. To see if this is the case for the now court declared unconstitutional capital gains income tax, I asked Washington’s Department of Revenue (DOR) what its current plans are. DOR essentially told me it’s proceeding the same way with the capital gains income tax as before the ruling. Here is my exch...

WASHINGTON STATE–Sound Transit is in the market for a new CEO and recently posted a recruiting brochure. The very first thing highlighted on the compensation and benefits slide after salary is: "No state income tax in Washington." Sound Transit isn't the first governmental entity in Washington to say no income tax is an advantage. Here is the Sound Transit job benefits slide: Local governments also understand that no income tax is a benefit. At least 24 local governments in the state have a...

OLYMPIA–A lot happened in the final hours of session. One thing that may have gone under the radar was a ruling by Lt. Governor Denny Heck that creates the potential for significant anti-transparent legislative games to be played in conference committee reports in the waning days of session. Conference Committee reports are what happens when the House and Senate can’t agree on a bill and form a committee to work out the differences. Though this is supposed to be a public process, the fact is the majority party usually works out the final bil...

OLYMPIA–Sorry to break the news, Washingtonians, but year three of living under emergency orders by the Governor will continue just as the last two years have–without meaningful legislative oversight. The House yesterday officially killed SB 5909. Though that bill as passed by the Senate was essentially fake reform, several amendments were introduced for the House floor debate to bring the policy back in line with what exists in the rest of the country by requiring affirmative legislative approval for emergency orders after a set period in tim...

A bill scheduled for a public hearing next week (HB 1727) would ban citizen ballot measures in odd years, but still allow local governments to call special elections to increase taxes. A similar bill was proposed in 2020. Former Secretary of State Kim Wyman testified against the idea of banning odd year ballot measures in 2020. Secretary Wyman noted these types of proposals would limit the people’s right of initiative and referendum and could add to voter fatigue by causing exceedingly long ballots. Though the claim is being made that, initiati...

In a 7-2 ruling this morning the State Supreme Court said the partial vetoes the Governor made in the 2019 transportation budget were unconstitutional. When issuing those vetoes the Governor said: “While my veto authority is generally limited to subsections or appropriation items in an appropriation bill, in this very rare and unusual circumstance I have no choice but to veto a single sentence in several subsections to prevent a constitutional violation and to prevent a forced violation of state law.” The State Supreme Court disagreed tod...

By Jason Mercier TVW recently held a Q&A event between students and the Governor discussing various topics. The full interview is worth watching. Topics included dam breaching, homelessness, climate policy, police reform and vaccine mandates. One question was about the governance structure of the state and whether there should be more statewide elected officials to help improve bipartisanship. The Governor replied instead that there should be fewer statewide elected officials to improve accountability (31 min mark). We agree. At present the...

Washington state ranks among the bottom for states that provide legislative oversight of executive emergency powers. What’s Washington doing wrong? We explore the problem and need for reform in this new video (WPC video here). In an emergency, governors need broad powers to act fast. Legislative bodies inevitably take longer to assemble and act than a single executive, so they temporarily delegate their power to the executive in emergencies. But these powers are supposed to be transferred for a limited period of time. For example, in W...

Cities across Washington are acting to ban a local income tax. In one example, this November voters in the city of Yakima will consider ballot measure Proposition 3, a charter amendment that would prohibit city officials from imposing a local income tax. The effort comes as state lawmakers this year enacted Washington’s first statewide income tax, on capital gains income, a bill whose constitutionality is being challenged in the courts. Other cities have already acted to prevent a local income tax. A similar charter amendment was adopted by 7...

As more cities act to ban a local income tax, detractors claim this effort to protect taxpayers is a waste of time. I really wish there wasn’t a concerted effort to bring the state of Washington and its cities an income tax. Unfortunately, that’s not the case. The claims that proposals to ban a local income tax are “a red herring” and that “no one is talking about an income tax” reminds me of the debate during the past decade in the legislature. Similar arguments were made during the 2017 floor debate on SJR 8204, a proposed constitutio...

While we wait for the capital gains income tax litigation to work its way through the courts, the University of Washington’s Law School has posted an interesting video: “Three-minute Legal Tips: Capital Gains Tax.” The video is a short interview with Professor Scott Schumacher, Director, Graduate Program in Taxation. Of particular note were these comments from Professor Schumacher: “A capital gains tax is just a tax on certain type of income…To the extent this is an income tax, and I think it is, it’s going to be found unconstitut...

By Jason Mercier The City of Battle Ground could soon join Spokane, Granger and Spokane Valley in banning a local income tax. At its July 19 meeting the city council will consider Resolution Number 21-07 (Regarding Opposition To A Local Income Tax On The Residents And Businesses Of The City, And Other Matters Relating Thereto.). Here is what Mayor Adrian E. Cortes told me about the resolution: “There’s absolutely no reason to impose an income tax in our community. Period. This policy sends a clear message to our residents and small businesses t...

Washington’s long delay to re-opening has seemed very arbitrary. There isn’t anything scientific about June 30 in the fight against COVID but hitting that date on the calendar is the trigger necessary for the Governor to finally join 48 other states in lifting most of the emergency restrictions. While other states are also lifting their emergency declarations, Governor Inslee has indicated he plans to keep his in place. This is a good reminder that as we celebrate a return to semi-normalcy that the state’s emergency powers are still in need...

Washington's quarterly revenue forecast today showed yet another huge increase in tax revenue. This is $2.6 billion more than was previously expected when lawmakers wrote the 2021-23 budget earlier this year. We now have $2.6 billion reason for lawmakers to finally provide broad-based tax relief to Washingtonians. While the majority party in our state was busy imposing an unconstitutional capital gains income tax this year, lawmakers across the country were instead working to provide...

OLYMPIA–The Thurston County Superior Court issued a ruling last Friday (June 11) in the lawsuit the Secretary of State filed against the Governor for clarification on how to handle his simultaneous two-handed and off-camera signings of two broadband bills. By granting the Secretary of State’s petition in-part, the judge is essentially allowing Secretary Kim Wyman to do the job the Governor should have done the first time and determine which order the bills should take effect for legal implementation. The Secretary of State’s original petit...